International Northair Mines Files NI 43-101 Technical Report on SEDAR For Maiden Resource Calculation of La Cigarra Silver Project, Mexico

International Northair Mines Ltd. (TSXV: INM) (the "Company" or "Northair") is pleased to announce that, in compliance with National Instrument ("NI") 43-101, it has filed on SEDAR the Technical Report for the maiden resource estimate, as released on February 26, 2013, for its La Cigarra silver project located in north central Mexico. The Technical Report titled "San Gregorio / Las Carolinas Resource Technical Report, La Cigarra, Chihauhua, Mexico" was completed by JDS Energy and Mining Inc. with the resource estimate by Arseneau Consulting Services ("ACS") and is available on the Company's website by clicking the following link:

Resource Estimate

The resource estimate contained in the Technical Report was calculated based on results from 143 of 154 holes totaling 25,576 metres drilled along the open ended La Cigarra mineralized system which has a drilled strike length of at least three (3) kilometres. The 143 holes included in this initial resource estimate were positioned within a potentially surface minable mineralized area comprised of the San Gregorio and Las Carolinas mineralized zones, which combined form a total strike length of 2.1 kilometres within the known three (3) kilometres. The mineral resource estimate was constrained by a Whittle™ pit shell at an economic cutoff grade of 30 g/t of silver and metallurgical recoveries of 84% silver. Highlights of the mineral resource estimate are as follows:

- Measured and Indicated mineral resources of 50,494,000 ounces of silver within 20,755,700 tonnes at an average grade of 76 g/t silver;

- Inferred mineral resource of 3,515,900 ounces silver within 1,780,000 tonnes at an average grade of 61 g/t silver;

- Higher than average grade zones outcrop, which could improve the assumed project economics in the early years;

- Significant by-products include 40,100 ounces of gold in the measured and indicated categories as well as appreciable lead and zinc values, as provided in mineral resource estimate tables noted below.

| Category | Tonnes* | Ag (g/t) | Au (g/t) | Pb (%) | Zn (%) | Ag Oz | Au Oz | Pb Lbs | Zn lbs |

|---|---|---|---|---|---|---|---|---|---|

| Measured | 6,235,000 | 65 | 0.06 | 0.10 | 0.16 | 13,090,800 | 12,100 | 13,161,500 | 21,706,600 |

| Indicated | 14,520,700 | 80 | 0.06 | 0.10 | 0.14 | 37,402,800 | 28,100 | 32,924,700 | 45,983,100 |

| M + I | 20,755,700 | 76 | 0.06 | 0.10 | 0.15 | 50,494,000 | 40,100 | 46,086,200 | 67,689,700 |

| Inferred | 1,780,150 | 61 | 0.05 | 0.10 | 0.12 | 3,515,900 | 3,000 | 3,959,300 | 4,865,700 |

The mineral resources of the La Cigarra Project are sensitive to cut-off grade. To illustrate this, the block model quantities and grade estimates within the conceptual pit are presented in the following table at different cut-off grades.

| CLASS | Cut-off | Tonnes (000) | Ag (g/t) | Ag (oz) | Au (g/t) | Pb (%) | Zn (%) |

|---|---|---|---|---|---|---|---|

| Measured | >100 Ag g/t | 803 | 137 | 3,548,500 | 0.08 | 0.14 | 0.17 |

| > 50 Ag g/t | 3,571 | 85 | 9,741,200 | 0.07 | 0.11 | 0.18 | |

| > 40 Ag g/t | 4,753 | 75 | 11,434,300 | 0.06 | 0.11 | 0.17 | |

| >30 Ag g/t | 6,235 | 65 | 13,090,800 | 0.06 | 0.1 | 0.16 | |

| >20 Ag g/t | 8,220 | 56 | 14,676,900 | 0.06 | 0.08 | 0.14 | |

| > 10 Ag g/t | 11,689 | 43 | 16,301,200 | 0.05 | 0.07 | 0.12 | |

| Indicated | >100 Ag g/t | 3,578 | 156 | 17,968,000 | 0.08 | 0.15 | 0.19 |

| > 50 Ag g/t | 9,235 | 104 | 30,834,800 | 0.07 | 0.12 | 0.17 | |

| > 40 Ag g/t | 11,273 | 93 | 33,763,100 | 0.06 | 0.11 | 0.16 | |

| >30 Ag g/t | 14,521 | 80 | 37,402,800 | 0.06 | 0.1 | 0.14 | |

| >20 Ag g/t | 19,539 | 66 | 41,381,600 | 0.06 | 0.09 | 0.13 | |

| > 10 Ag g/t | 27,714 | 51 | 41,381,600 | 0.05 | 0.07 | 0.11 | |

| Inferred | >100 Ag g/t | 160 | 139 | 717,400 | 0.06 | 0.15 | 0.18 |

| > 50 Ag g/t | 936 | 82 | 2,467,000 | 0.06 | 0.12 | 0.15 | |

| > 40 Ag g/t | 1,252 | 73 | 2,920,200 | 0.06 | 0.11 | 0.14 | |

| >30 Ag g/t | 1,780 | 61 | 3,515,900 | 0.05 | 0.1 | 0.12 | |

| >20 Ag g/t | 2,497 | 51 | 4,091,200 | 0.05 | 0.09 | 0.11 | |

| > 10 Ag g/t | 3,386 | 41 | 4,689,300 | 0.05 | 0.08 | 0.09 |

The development of the comparative tables has relied on the work of experts as described in this release. The following factors should also be noted:

- Mineral resources were estimated in conformance with the CIM Mineral Resources definitions referred to in National Instrument 43-101, Standard of Disclosure for Mineral Properties;

- The resource estimate considered the results of 154 drill holes totaling (25,576 metres) and was calculated by using 143 of these holes;

- Mineral resources were estimated by ordinary kriging in 10x10x10 metre blocks. Grades were capped to 500 g/t silver in the high grade portion of the mineralization:

- Mineral resources were classified as Measured if at least three (3) drill holes were found within a 75 x 50 x 25 metre search radius. Blocks were classified as Indicated if two (2) drill holes were found within a 75x50x25 metre search radius and blocks were classified as Inferred if at least three (3) drill holes were found within a 100x75x30 metre search radius;

- The "reasonable prospects for economic extraction" requirement generally implies that the quantity and grade estimates meet certain economic thresholds and that the mineral resources are reported at an appropriate cut-off grade taking into account extraction scenarios and processing recoveries. In order to meet this requirement, ACS considers that major portions of La Cigarra mineralization are amenable for open pit extraction;

- In order to determine the quantities of material offering "reasonable prospects for economic extraction" by an open pit, ACS, with the assistance of JDS, used Whittl™ pit optimization software and reasonable mining assumptions to evaluate the proportions of the block model (Measured, Indicated and Inferred blocks) that could be "reasonably expected" to be mined from an open pit;

- The optimization parameters, found in the table below, were selected based on experience and benchmarking against similar projects. The reader is cautioned that the results from the pit optimization are used solely for the purpose of testing the "reasonable prospects for economic extraction" by an open pit and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the La Cigarra Project. The results are used as a guide to assist in the preparation of a mineral resource statement and to select an appropriate resource reporting cut-off grade.

| Parameter | Value | Unit |

|---|---|---|

| Silver Price | $ 29.20 | US$ per ounce |

| Lead Price | $ 1.00 | US$ per pound |

| Zinc Price | $ 0.95 | US$ per pound |

| Mining Cost | $ 2.00 | US$ per tonne mined |

| Processing (Sulphide material) | $ 15.00 | US$ per tonne of sulphide feed |

| Processing (Oxide Material) | $ 12.00 | US$ per tonne of oxide feed |

| General and Administrative | $ 1.00 | US$ per tonne of feed |

| Overall Pit Slope | 45 | degrees |

| Silver Flotation Recovery | 84 | Percent |

| Lead Flotation Recovery | 75 | Percent |

| Zinc Flotation Recovery | 60 | Percent |

| Silver Leach Recovery | 90 | Percent |

| Lead Payable | 95 | Percent |

| Silver Payable in Lead Conc. | 95 | Percent |

| Zinc Payable | 85 | Percent |

| Silver Payable in Zinc Conc. | 70 | Percent |

| Silver Dore Payable | 100 | Percent |

Immediate Resource Expansion Potential

Immediate exploration potential at La Cigarra exists within and adjacent to the current resource area (between sections 6+00S in Las Carolinas and 3+50N in San Gregorio) at a 30 g/t silver cut-off as presented in the table below. The potential silver quantity and grade is conceptual in nature as there has been insufficient exploration to define a mineral resource and it is uncertain that further exploration will result in the target being delineated as a mineral resource. This exploration quantity and grade was determined based on a single drill hole within the 100m search ellipse.

Immediate Exploration Potential adjacent and within the San Gregorio/Las Carolinas Zones, La Cigarra Project

| Potential In-Situ Grade | Potential Contained Metal | |||||

|---|---|---|---|---|---|---|

| Category | Tonnes (000) |

Ag (g/t) |

Au (g/t) |

Pb (%) |

Zn (%) |

Ag (oz) |

| Exploration Potential | 3,000 to 4,500 | 65 to 75 | ~0.06 | 0.09 to 0.1 | 0.13 to 0.14 | 6,000,000 to 10,000,000 |

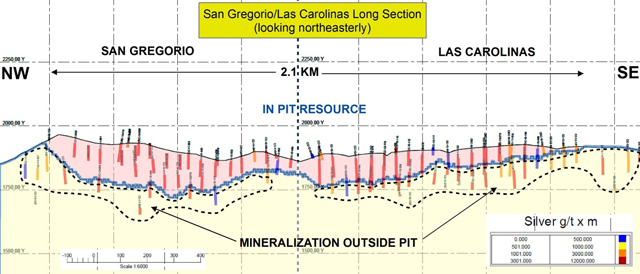

The long section (shown below) covering the San Gregorio and Las Carolinas zones demonstrates the meaningful drill intersections that encountered mineralization below and adjacent to the optimized pit, which were not included in the calculation of the resource estimate.

Furthermore, considerable resource exploration potential exists along the open continuous six (6) kilometre long La Cigarra mineralized system. This potential is in part supported by soil sampling along trend of the system, comprising the La Borracha Zone to the north (where nine (9) drill holes have intercepted significant silver mineralization) and the Las Venadas Zone to the south (which has returned surface silver values of up to 233 g/t silver over 2.5 metres). The defined target zone at Las Venadas covers an area of approximately 230 metres by 90 metres.

In addition, numerous other target areas within the remaining 32,000 hectare land package could host significant mineralization as evidenced by a cluster of historic workings and mineralized grab samples obtained from preliminary prospecting.

QA/QC

This news release has been prepared in accordance with Canadian regulatory requirements set out in National Instrument 43-101 and approved by Fred Hewett, the Company's President and CEO, and a Qualified Person under NI 43-101.

The resource estimation work was completed by Dr. Gilles Arseneau, P.Geo. of Arseneau Consulting Services and an independent Qualified Person as defined under NI 43-101.

About International Northair Mines Ltd.

Northair is a mineral exploration company engaged in the acquisition and development of gold and silver properties in Mexico. The Company is currently focused on advancing its La Cigarra silver project located in the state of Chihuahua, which hosts a robust NI 43-101 compliant silver resource estimate that also contains appreciable lead, zinc and gold values. Excellent exploration potential exists to the north of the deposit within the La Borracha Zone (where nine (9) drill holes have intercepted significant silver mineralization) and to the south where the extension of the La Cigarra structure has demonstrated a strong mineralized system with numerous drill targets. The permissive geology and attractive surface sampling results present a compelling opportunity to expand the known resource. The Company is presently prioritizing target areas for an expected 2013 drill program.

ON BEHALF OF THE BOARD,

INTERNATIONAL NORTHAIR MINES LTD.

"Fred G. Hewett"

____________________________________

Fred G. Hewett, P.Eng.

President & CEO

For further information please contact Fred Hewett, President & CEO,

Chris Curran, Manager, Corporate Communications or Brent Levenstadt, Investor Relations Associate

at 604-687-7545 or 1-888-338-2200

Website: www.northair.com/international/ Email: info@northair.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This news release may contain forward looking statements which are not historical facts, such as ore reserve estimates, anticipated production or results, sales, revenues, costs, or discussions of goals and exploration results, and involves a number of risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, but are not limited to, metal price volatility, volatility of metals production, project development, ore reserve estimates, future anticipated reserves and cost engineering estimate risks, geological factors and exploration results. See Northair's filings for a more detailed discussion of factors that may impact expected results.

This news release does not constitute an offer to sell or solicitation of an offer to sell any securities in the United States. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act") or any state securities laws and may not be offered or sold within the United States or to U.S. Persons unless registered under the U.S. Securities Act and applicable state securities laws or an exemption from such registration is available.